Words such as “commission”, “untrustworthy” and “expensive” feature heavily in the negative responses.

Based on the Lang Cat’s research, advisers can help tackle the trust issue by maintaining face-to-face services with clients.

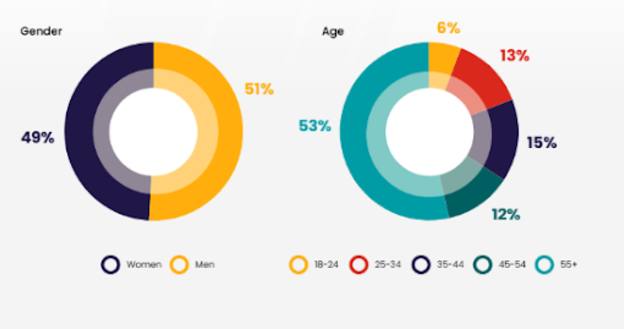

Who is paying for advice?

“Our research shows a strong correlation between the key services that advisers tend to offer and consumer preference for face-to-face support,” the report said.

“For retirement planning, consolidating pensions and understanding investment risk the preferred channel remains face-to-face.

“Digital/website services are preferred for the more administrative tasks such as applying for a new Isa, topping up an existing account or researching options.”

Other research from YouGov also supports this idea, with evidence from a prior study suggesting that people are wary of digital financial services and prefer face-to-face interactions.

Indeed, just 8 per cent of respondents said they are more likely to trust a robo-adviser over a traditional one. However, a further 21 per cent saw no difference between the two.

Awareness

The second barrier the Lang Cat report said the industry needs to address is around boosting awareness of the value of advice and on how individuals can find the right adviser.

The Lang Cat noted that outside of the paid advice sector, awareness of the government-backed guidance service, MoneyHelper, remains “alarmingly low” at 26 per cent - up marginally from 24 per cent in 2021.

Launched in 2021, the service brought together the Money Advice Service, the Pensions Advisory Service and Pension Wise and offers financial guidance to those who cannot afford advice.

According to the Lang Cat research, at 32 per cent, referrals by friends and family remain the top way clients decide to use an advice firm but this is only marginally behind individual research which now represents 31 per cent.

Confidence

Finally, among those who have paid for advice in the past two years, a lack of confidence in managing money is one of the main drivers for taking advice, especially for those who have complex financial matters.

In particular, people lack confidence when it comes to investment and pension-related decisions, with only around a third of people saying they are happy to look after these matters themselves.

In order to address these three barriers, the Lang Cat has said advisers must take action to improve trust and to encourage referrals.

“Somehow, the advice industry needs to improve its public perception, and get the message across that, 10 years on from RDR, it is now increasingly a profession.

“Adviser trade bodies must take the lead here, championing the value of quality financial advice. Individual advisers have a role to play as well, both within their local communities and also whistleblowing on the bad guys,” the report said.