Letters of authority are a significant barrier in the advice process, according to a report by the Lang Cat.

The Lang Cat's report 'Fragmented World' revealed that letters of authority (LOAs) and transfers remain a massive source of frustration for those working in advice firms and financial planning practices.

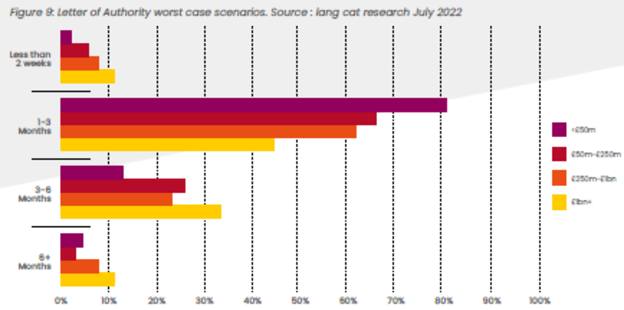

The Lang Cat tested the worst-case scenarios for time taken from submitting an LOA to getting full, satisfactory data and the timeframe often ran to several months.

In the very bad cases, firms were waiting over six months for the data they had asked for.

The research is based on more than 40 interviews with advice professionals ranging from the big consolidators and national firms to smaller specialists.

One adviser said: “LOAs are the bane of the industry, not just for advisers but for providers as well.

“It makes absolutely no sense at all for everyone not to kind of join hands and try and work on this. It’s a perfect example of an industry that has gone mad where we’re just creating more work for everybody.”

Another managing director of a financial planning firm said: “Technology allows our clients to go from 0-100 in terms of their engagement, but they then fall off a cliff with LOAs and transfers taking months to complete.”

The guilty parties

The Lang Cat supplemented this with online research, and also heard from providers, platforms and tech companies.

Through interviews with those professionals and providers, the guilty parties most frequently reported for frustratingly slow LOAs were legacy closed-book insurers and platforms who have grown by acquisition, as well as defined contribution providers, especially Mercer, Towers Watson and Capita.

The advice process can be broken down to three main stages - onboarding, implementing and reporting.

The first and last stages respectively can now operate completely digitally. Implementing a financial plan, however, is still a major issue because of LOAs.

To implement a plan for a typical client in their early 50s, the adviser will often have to deal with between five and 15 products, the Lang Cat explained.

This means advisers need to create anything between five and 15 LOAs and agency transfer forms in order to be able to take control of the client’s plans, which often takes several months.

The Lang Cat said some have tried to fix the problem, such as Origo and its Unipass LOA, but it’s still early days.

Principal Mark Polson said: “Despite the threat of regulatory action in this space, progress is not being made quickly enough. We need everyone to accept and adopt common standards before we see meaningful integration and automation.

“This part of the technological world needs to de-fragment before it can be fixed and properly connected.”

Wealth Wizards chief executive and founder Andrew Firth, said after the pandemic, there were a lot of processes sped up and barriers reduced for financial advisers.