Perhaps the most significant changes are those relating to taxation, which have been well documented.

Paul Shearman, Openwork’s proposition director for mortgages, protection and GI, says the upcoming tax changes will be key to assessing suitability of buy-to-let investing.

“The withdrawal of the higher rate tax reliefs on mortgage interest costs, beginning with 25 per cent of these costs having basic rate tax applied from April 2017, means landlords do have time to plan,” he suggests.

“But with the level of relief continuing to drop over the next four years, the impact will be significant for many landlords. It’s therefore important to consider how they’ll affect clients in the future, so that clients are aware of how the changes will impact them.”

He believes one option advisers should be discussing with clients is whether or not they should be moving properties or purchasing properties within a company structure, as corporation tax is currently levied at 20 per cent, with plans to lower this to 18 per cent by 2020.

He adds: “This is a big step and while there are pros and cons to incorporating, the financial savings can be significant. Advisers should be exploring this issue with clients and recommending the use of tax/legal advisers as appropriate.”

Tax advice

Buy-to-let investing is a specialism and many financial advisers will also point their clients in the direction of a tax specialist as well.

John Heron, managing director at Paragon Mortgages, urges: “Advisers need to make sure their customers are aware of the tax and mortgage affordability changes. They should encourage customers to get professional advice on tax issues and to contact organisations such as the National Landlords Association who will be able to signpost valuable information and advice.”

Donna Hopton, a director at Cherry, agrees advisers need to be fully conversant with the tax changes that have affected the buy-to-let market recently to ensure the advice they give is “up to scratch”.

She points out: “The real effect of Clause 24 [changes to tax relief] means that essentially there is now a tax on turnover and not profit. People need to understand this immediately or there will be risks to consumers – and of course to advisers.”

Case Study 1:

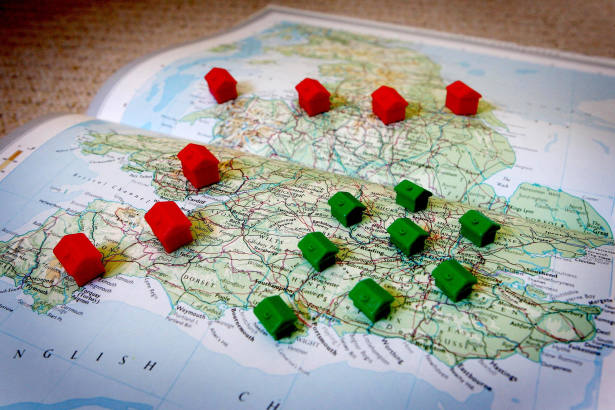

Ms Hopton cites one example: “We were advised of a case where a client has 14 properties, earns £60,000 and pays around £16,000 in tax, leaving her with a net income of £44,000.