As an industry we have spent many years discussing pensions dashboards. But now the plans are about to become a reality.

Pensions dashboards will allow people to see information about all their pensions in one place. It will include all their private pensions, defined benefit or defined contribution, retail or workplace, old or new, as well as any public sector pensions and, importantly, their state pension as well.

The government is firmly behind the development of pensions dashboards. It hopes they will help people trace lost pensions, maybe from previous employers or from pension providers that have been acquired by other companies over the years.

It also hopes people will better engage with their pensions when they can see all the information in one place.

By building a picture of their expected later-life income, people could be inspired to monitor investments, increase contributions, consolidate accounts, and make better retirement decisions.

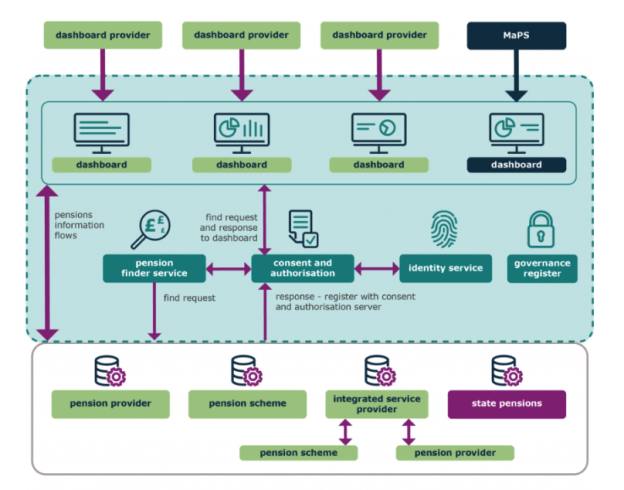

The government has asked the pensions dashboard programme (PDP), part of the Money and Pensions Service, to build the pensions dashboards. Lying at the heart of the PDP’s proposition is the ‘ecosystem’.

How will this ecosystem work?

Put simply, people will, via a dashboard, ask to see their pensions. Once the person’s identity has been verified, the pension-finder service part of the ecosystem will fire their details to all pension schemes.

If the pension scheme has a match to those details it will let the ecosystem know and, once the individual has given consent, will send information to the dashboard. The individual can then view all their pension schemes’ information on the dashboard.

The ecosystem is an elaborate postbox. It will not hold information. Nor will it do any computation. It will simply make sure all the relevant data control permissions have been given, and pass information from the dashboard to the pension scheme, and from the pension scheme to the dashboard, according to the PDP.

The pension dashboard ecosystem

Who will provide a dashboard?

Maps will offer a pensions dashboard. However, the government realises that if there is only one dashboard provider in operation then many people will never learn it exists, let alone use it.

So, the government is allowing others to offer commercial dashboards. Only qualifying pensions dashboard services (QPDS) will be allowed to provide a dashboard.

These organisations will have to be regulated by the Financial Conduct Authority and hold the relevant permissions for this new activity. The FCA will be setting the rules governing QPDS.

Many pension providers and schemes may choose to offer a commercial dashboard, as will banks and other financial institutions. Financial advisers and planners might also decide to offer this to clients.

What information does someone have to put into a dashboard?

Verifying an individual’s identity will be critical. Dashboards will use the matching criteria of name, surname, date of birth and current address to achieve this.