It’s harder than it looks to gauge the mood music of the self-invested personal pension (Sipp) market at present. Another year of strong growth on the back of pension freedoms has been music to providers’ ears. But at the same time, there is an insistent, less positive undertone still to be played out.

While operators are enjoying the increased interest in Sipps that was sparked by the 2015 pension reforms, their greater prominence has brought further scrutiny from regulators. More important still is the sense that legacy investments may yet come back to haunt certain providers.

“Not all providers who have taken on non-standard investments will have issues, but this topic is still a bit of a cloud hanging over the bespoke part of the market,” says John Moret of consultancy MoretoSipps.

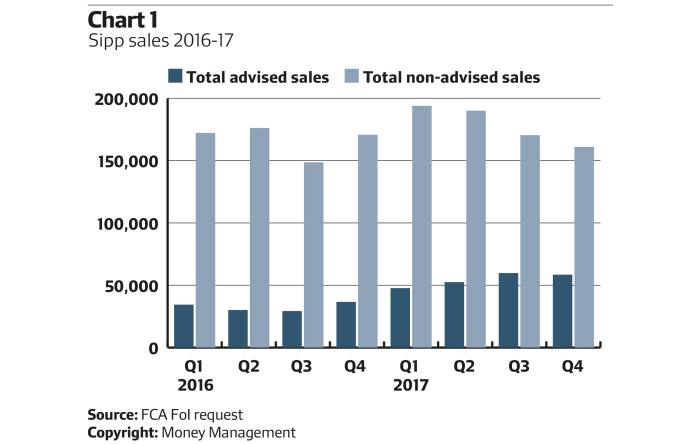

When it comes to sales, statistics provided by the FCA to Money Management following a freedom of information request show a mixed picture. As Chart 1 indicates, the number of advised Sipp sales reached new heights in 2017, rising to a peak of 59,786 in the third quarter.

But non-advised sales, having reached a peak of their own at the start of the year with a record 193,940 sales in the first quarter, fell away sharply in the final six months. The fourth quarter saw the figure drop to 160,989 – the lowest level for more than a year.

There are several possible reasons for this. It’s plausible that some of those who were previously execution-only customers have shifted to the advised market due to market pressures: wary of accepting transfers facilitated by introducer firms, several Sipp providers do not accept non-advised business. But operators’ policies on this front have typically been in place for some time, and the shift in sales patterns is clearly a more recent phenomenon.

More pertinent, perhaps, is the volume of defined benefit (DB) transfer money now ending up in Sipp structures. The requirement for transferees to take advice when moving their DB pension will probably have had an impact on the nature of the Sipp sector.

That will be a relief to those who insist that advised business is the only way forward for the market – though the British Steel Pension Scheme (BSPS) saga is a reminder that regulated advice itself is not free from unscrupulous activity.

Whatever the reason, Table 3 shows that business levels have continued to flourish for most providers.

This table, and others, displays one marked difference with those found in previous surveys. As Table 5 shows, we have split platform and ‘full’ Sipp providers for the first time, in the hope of better comparing like with like. There’s no doubt the market is continuing to split between those wrappers that – like other non-workplace pensions – typically invest in collective funds, and those that encompass property purchases and other assets. But a couple of the more flexible Sipps offered by platform providers have been kept in the main tables.

While platform providers have seen growth rates tick upwards slightly, the number of plans being opened at the likes of Barnett Waddingham, InvestAcc, DP Pensions and Organon are all up roughly 20 per cent on figures reported in our previous survey. That suggests a booming market, although a similar uptick in the number of plans being closed should not be overlooked.