Millennials were once again the focus of Philip Hammond’s few give-aways in a Budget that was “about much more than Brexit”, or so the chancellor said.

Building on the strategies of recent years to encourage long-term savings among the nation’s youth and to help them on the housing ladder, the big-ticket draw in Mr Hammond’s Autumn Budget 2017 was stamp duty relief.

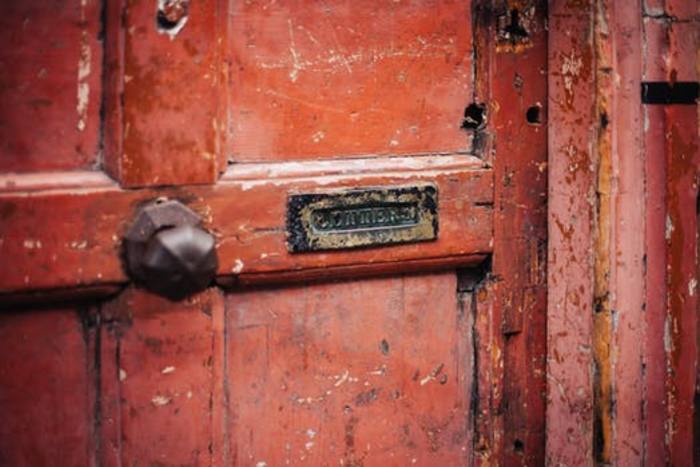

The government announced stamp duty land tax (SDLT) relief for first-time buyers on properties up to £300,000, or on the first £300,000 of properties of up to £500,000 in London and the south east.

This Budget pledge was definitely skewed towards the younger first-time buyer; those older Britons who may have considered downsizing to a property within those values and thought they might be in for SDLT relief will be disappointed. Downsizing is not included.

Responding to this, Steven Cameron, head of pensions for Aegon, says: “We would like the chancellor to go a step further and cut stamp duty for those downsizing or buying cheaper properties.

"This would have the double benefit of freeing up family homes for families while boosting funds to pay for retirement.”

Big buts

The SDLT relief for first-time buyers is good news on the face of it, and certainly marked the climactic end to Mr Hammond’s hour-and-two-minute long speech.

Yet as with so many headline-grabbing announcements, there is usually a big but to add. In this case, there seem to be two.

First of all, the fact that house prices have risen so strongly, particularly in London and the south-east, means there simply won’t be enough properties lying within this £300,000 limit to benefit enough people.

Worse, the largesse of this Budget move to attract millennials might end up escalating the problem of high house prices. FTAdviser reported that even the Office for Budget Responsibility (OBR) believes the stamp duty boost will benefit sellers rather than buyers.

Mike Hodges, partner at accountancy firm Saffery Champness, explained: "The risk is that sellers will be tempted to negotiate harder on price if they know the purchaser is not paying stamp duty."

The OBR also claims the abolition of SDLT could see house prices rise by twice the amount saved by the buyer, because it is a permanent measure rather than a temporary holiday.

Moreover, the predicted savings might not actually be that great, when worked out on paper.

According to Tom Selby, senior analyst at AJ Bell, the cut will not benefit people outside of London and the south east to the same degree, because of the high house price differential.

He explains: “The saving based on the average house price for first-time buyers in the UK will be £1,654. However, this more than doubles in the south east to £3,839 and in London it would be £5,000.