When Terry Smith was launching an emerging markets investment trust under his Fundsmith brand in 2014, his determination and bullishness were obvious.

The trust was the next project for the fund house that had already made an immediate splash with its Fundsmith Equity product – a fund that combined stellar early performance and canny marketing to grow rapidly, and is now the largest UK retail fund at around £24bn in size.

Smith’s bullishness centred on his belief that “the emerging markets trust should be able to outperform Fundsmith over 10 years".

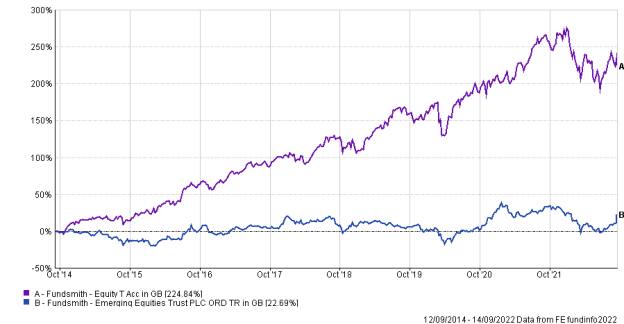

That was a bold claim, and one that never looked even close to coming to fruition, as the chart below shows.

It compares the performance of the trust and of the Fundsmith Equity fund, with the emerging markets equity trust returning 6 per cent over the past five years, compared with 75 per cent for the main Fundsmith fund.

Those struggles culminated with this week's announcement that the trust is to wind up and return cash to shareholders, a move welcomed by industry commentators.

The performance has been poor, both for what might be called big picture reasons, such as heavy exposure to the underperforming Indian market, but also specific factors around the investment style and its capacity to work as well in emerging markets as it has in developed markets.

The exposure to India, a commodity importer, has proved unwise, at a time when commodity prices have risen stoutly and while higher commodity prices would be expected to benefit many emerging markets – the Fundsmith Emerging Market Equity trust has a 5 per cent exposure there, leaving it the wrong side of market movements this year.

In addition, when Smith launched the fund he said he felt emerging market economies would grow at a faster pace than developed markets, and therefore that emerging market quality growth companies of the type he liked should beat the performance of similar companies in developed markets.

However it has not worked out that way.

His investment style is to invest in established, relatively mature growth companies, but one of the challenges associated with emerging markets is that there are comparatively few such businesses, as by definition, economies at an earlier stage of economic development have fewer mature companies.

At £377mn the trust was hardly sub optimal in size, with a chunky ongoing charge of 1.3 per cent, and it would generate gross revenue for the Fundsmith management company of more than £4mn.

Smith, who while chief investment officer at Fundsmith, hasn’t run the investment trust on a day-to-day basis since May 2019, therefore closed the trust because “it fell below expectations”.

Since 2014, emerging markets have sharply underperformed relative to developed markets, as the chart below shows, implying that, whatever happens about respective GDP growth rates, this is not being reflected in relative stock market performance.