When Jonathan Toub first became an emerging markets fund manager in 2004, it seemed as though he was joining at the perfect time.

The collapse of the Soviet Union and the emergence of China as a global economy pushed risk premia lower, led to greater globalisation which kept inflation low, and drove demand for commodities produced in many emerging markets.

Those factors led to a period of sustained economic growth and low inflation globally, which continued right up until the global financial crisis.

During the time, the prospects of many companies were viewed through the prism of their exposure to emerging markets – just as many are now viewed through the prism of environmental, social and governance factors – and while the global financial crisis derailed markets and economies, what emerged afterwards was a continuation of the previous trend, but with even more global demand coming from the emerging world.

Emerging markets are an asset class that, for the reasons above and more, have attracted considerable client interest over the past two decades, yet returns have generally been weak – but with commodity prices higher, is now the time for emerging markets to outperform?

That global expansion happened in such a way that interest rates remained very low, which should also have helped the investment case for emerging markets, as it effectively incentivised investment into riskier assets.

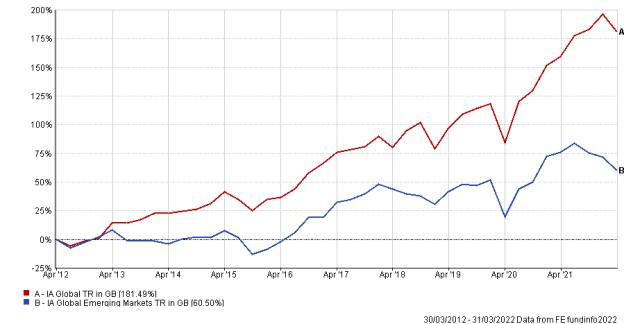

But despite all of that big picture stuff, as the chart below shows, emerging market equities have sharply underperformed over the past decade, with returns just a third of those of the wider Global sector.

Toub, a portfolio manager at Aviva Investors, says part of the problem is that many countries in the emerging world have “wasted” the gains by embracing populist or authoritarian politics, so that even as the bigger picture has improved, this has not really translated into better prospects for stock markets in the region.

He describes this period as a "phenomenal one" for emerging market economies, but now says: "The reversion of some of those long-term trends means we now have a very tricky period for merging markets."

Neil Veitch, investment director at SVM, says that while many countries in the emerging world have tremendous economies – he cited the Philippines as an example – it is difficult to invest in that economic growth via the stock markets of those countries, with better opportunities to do so by investing in companies listed on global developed markets.

Toub says that many of the macro-trends that boosted emerging economies in the 30 years prior to the pandemic now risk going into reverse, with geopolitical uncertainty around the world increasing the desire of clients to be in safe haven assets at precisely the time that government bond yields, typically viewed as the safest of all havens, are rising.