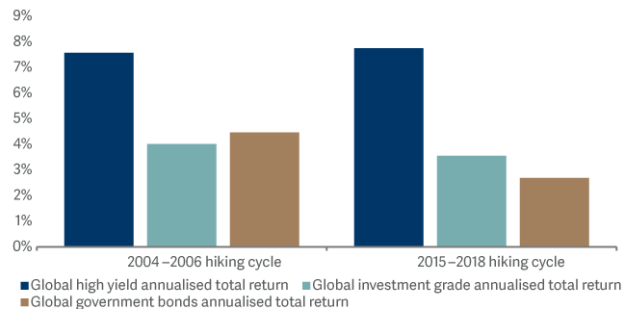

High yield outperforms in hiking cycles

Improving quality in the high-yield market

And the argument then goes on, surely all this loose monetary policy over the last decade has meant that lots of companies have received loans that shouldn’t have? I would counter this by saying that over the last 20 years – and particularly over the period since the global financial crisis – the high-yield market has got better and better in terms of credit quality. Put simply, the high-yield market has never seen a higher proportion of lower-risk (BB-rated) credits than today; or a lower proportion of higher-risk (CCC-rated) credits.

This has happened for a variety of reasons – downgrades of very good companies from investment grade have helped, as have private equity sponsors learning from their mistakes in the lead-up to the global financial crisis, and the cleansing effect of both the 2015/2016 and Covid default cycles. However, the sum of these factors is that – unlike other parts of the credit market, such as leveraged loans – high yield has never been higher quality than it is today.

High yield or equities?

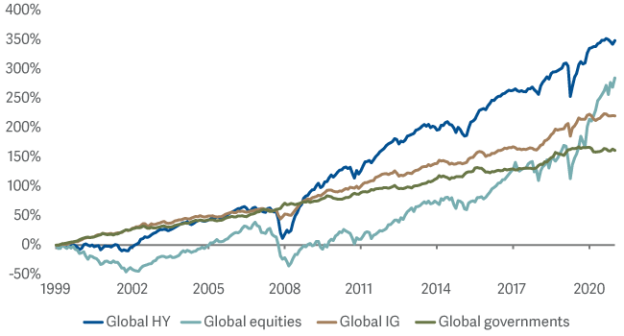

The critic then accepts that high yield is usually a beneficiary of the hiking cycle and could do well as we move from quantitative easing to quantitative tightening. But the next point raised is whether investing in equities would give more solid long-term returns with less exposure to heavy losses around recessions. In fact, high yield has produced higher total returns than equities over the past 20 years (see Chart 2).

20 years of outperformance...

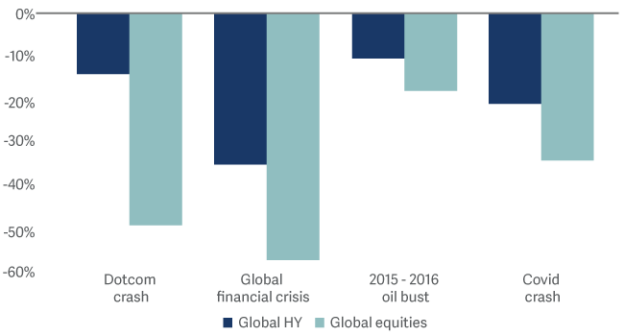

In addition, it is better insulated in sell-offs. As Chart 3 shows, peak-to-trough high yield has outperformed equities in every major sell-off since the millennium.

Lower peak-to-trough drawdowns than equities

To conclude, apart from the strong performance through hiking cycles, vastly improved credit quality, superior long-term returns against equities, and improved drawdown (and recovery) characteristics, what has high yield ever done for us?

Jack Holmes is co-manager of Artemis Funds (Lux) – Global High Yield Bond, for more information please visit the fund page.

[1] Source BoAML 26 April 2022.