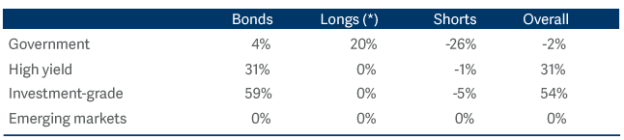

3. Flexibility to allocate capital to those sectors that are potential beneficiaries of inflation.

Rather than attempting to track bond indices, our goal is to outperform the Bank of England’s base rate by at least 2.5 per cent a year. That allows us to disregard sector weightings in bond indices, giving us the freedom to avoid sectors for whom inflation would be harmful.

Equally, we can allocate capital to bonds issued by companies in a handful of sectors, most notably financials, which could potentially benefit from an environment associated with strong economic growth, higher bond yields and steeper yield curves.

In contrast to most conventional bond funds, we also take relative-value trades in the government bond market...

1. We can use inflation positions to express our views on the magnitude and evolution of inflation over time.

This can be either in a particular economy in isolation, or on a relative basis between countries. We can observe the market’s expectations for inflation stretching for decades to come using inflation breakevens (the difference between ‘nominal’ and ‘real’ yields for a given tenor). In the UK, for example, we can observe the market’s expectations for average RPI for the next 50 years.

We can then judge whether we think the market is overstating or understating the risk of inflation – and take positions accordingly.

For instance, we might take the view that the risk of inflation in the US over a particular time horizon (such as the next 10 years) is not being fully priced in. In that scenario, we could profit as the market’s inflation expectations begin to converge with ours. Or, if we were to hold the position to maturity, to profit from the difference between realised inflation and implied inflation.

We currently believe inflation valuations in a number of economies are compelling – but not in the UK.

We therefore maintain a short inflation position in the UK (concentrated in long-dated, 10 to 20-year tenors) set against long exposure in Europe (towards the front end of the curve).

2. We use ‘curve trades’ to express our views on term premiums.

Yield curves can be conceived of showing two things in the same line: firstly, interest-rate expectations and, secondly, a term premium. This term premium is, in effect, the additional yield that bond investors demand in compensation for uncertainty about the future. Inflation risks constitute a large part of that term premium.

Clearly, the higher inflation expectations are, the greater the risk that inflation will erode the value of the nominal cash payments that a bond’s owner will receive in the future – and, naturally, the higher the premium investors will demand. Because there is more time for risks to materialise as time passes, longer-maturity bonds normally carry a higher inflation premium.