Initially rocking China, Covid-19 has rapidly become an economic shock for the global economy.

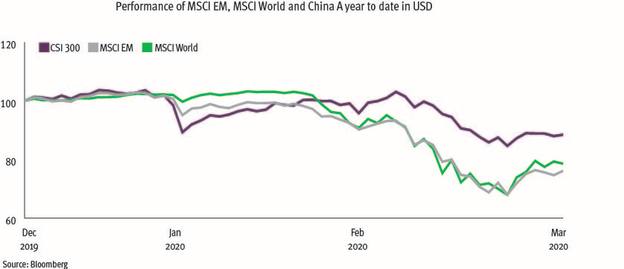

Against this backdrop of broadening concerns on the spread of the virus, emerging market equities dropped more than 30 per cent per cent earlier in March, partially recovering in the past week following the US Federal Reserve’s unlimited quantative easing pledge and the fiscal stimulus package from the US, ending the quarter down 23.6 per cent.

In contrast, China A shares have been more resilient, dropping only 11.5 per cent in the first quarter of 2020.

To counteract the shocks from the pandemic, some countries have deployed aggressive monetary and fiscal policy responses, precisely aimed at preventing a downward spiral into a financial crisis.

Central banks have flooded liquidity into markets, prudential regulators have been easing capital requirements, and fiscal authorities are providing sizeable loan guarantee schemes.

China has moved quickly to bring the virus under control and while a few other EM countries have gone into lockdown, particularly some Asian countries, a number of emerging countries have been slower to respond.

The coronavirus spread is therefore expected to continue to escalate even while containment measures are currently being ramped up in most EM countries.

Monetary and fiscal stimulus from EM has generally been more muted so far. EM central banks have been more willing to loosen policy than in the past, but are balancing capital flight in this risk-off environment, which has put pressure on currencies.

The inflation backdrop has been benign in most EM countries in recent years, and while EM central banks will have some concern about the impact of imported inflation due to currency weakness, this should be mitigated by both the oil price supply shock and the fact that the impact of Covid-19 is generally expected to be deflationary.

The recent Fed action to provide US dollar swap lines is easing liquidity pressure in EM where foreign banks can swap treasuries for dollars.

Importantly, the financial health of many EM countries, corporates and households are entering this crisis in better shape than in previous crisis times.

The drop in the oil price is positive for most of Asia.

Although oil-rich countries, such as Russia, are suffering from this – its National Wealth Fund has built a buffer to help offset lower oil price periods.

We are most comfortable with our equity exposure to China.

In some sense, China shows the roadmap ahead: extreme containment measures that control the virus spread at the cost of upfront economic pain, but which have allowed for a gradual normalisation in activity.

There have been no new cases of Covid-19 reported in most areas, factory production has largely resumed and Shanghai is almost back to business as usual, with shopping and traffic levels gradually increasing at the time of writing.