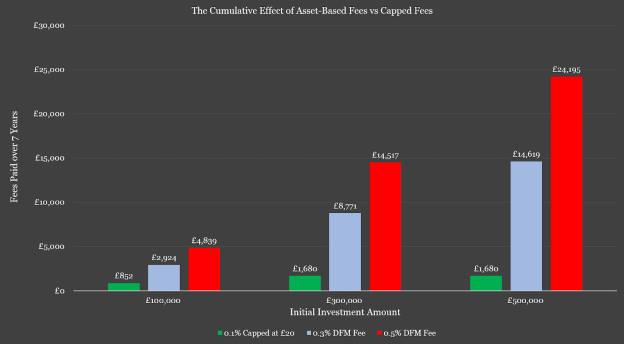

Asset-based fees increase exponentially with wealth.

A £500,000 client portfolio with a 0.5 per cent portfolio management fee will accrue £2,500 in discretionary management charges in one year.

The same client will pay just £240 over the same period when fees are capped at £20-a-month.

The difference between the two charging structures is staggering, and this disconnect increases over time as the impact of fee drag bites.

As shown below, an investor with £500,000 over seven years in a portfolio charging an OCF of 0.5 per cent will pay some £24,195 in fees, while that same investor would be charged just £1,680 over the same period if fees were capped at £240 annually.

Chart 2: shows the cost in 10bppa steps for three different size portfolios over one, three and seven years.

It underlines the benefit of a capped fee proposition.

Initial research carried out by financial services consultancy the Lang Cat suggests that investors are already sold on the benefits of a fixed or capped fee model for their portfolio.

Over 80 per cent of those surveyed voiced support for the concept, with the most frequently chosen price point for fees coming in at between £20- and £30-a-month.

Time for a new approach

Clear demand exists for an innovative approach to portfolio charges in a world where a flawed model has dominated for so long.

A flat world – where the playing field across fees is levelled – should be embraced, not feared.

If we truly feel our investment solutions are sound, then none of us should have anything to hide.

In a time where value is being questioned across the whole investment sector, there’s still a woefully low number looking to reduce or cap fees.

It is an approach that has the potential to disrupt the status quo by appealing to advisers and investors of all types.

Mark Northway is Investment Manager at Sparrows Capital