Fee pressures, the difficulty of consistently outperforming markets and the very high-profile woes of the UK’s best-known stockpicker have not made life easy for advocates of active investing.

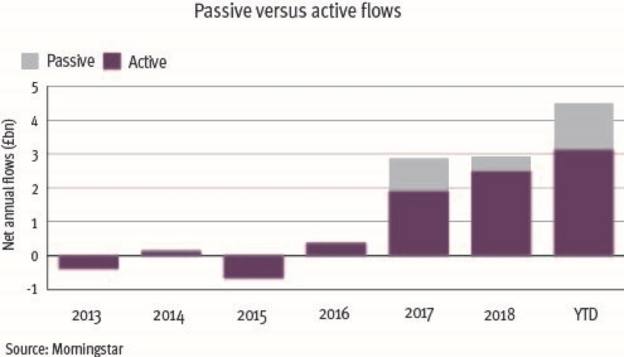

These factors, among others, have helped passives accrue a greater chunk of assets recently.

UK retail investors put £10.4bn into trackers on a net basis in the first eight months of 2019 according to Investment Association data, ahead of the £6.6bn net inflow registered by funds overall.

The growth of passive

Active still does have a place, particularly in those cases where managers can either consistently outperform the market or access a niche area that is difficult to track.

And values-based investments, from ethical approaches to funds paying attention to environmental, social and governance criteria, remain an area of growth for active managers because of the due diligence and careful selection involved.

Key Points

- Passive investing has become very popular in recent years

- Some companies are launching passive indices

- Investors need to be aware of their exposure

More than three-quarters of respondents to the Schroders 2018 Global Investor Study said sustainable investing, for example, had become more important to them in the past five years.

But ESG approaches and passive funds are not mutually exclusive. As Financial Conduct Authority chief executive Andrew Bailey noted in a 2018 speech to the IA’s culture conference, they should at the very least sit alongside each other.

“A longer-term shift towards passive investing goes alongside a desire for more ethical and socially responsible investing and a desire to encourage longer-term patient capital,” he said.

“Of course, these two developments can co-exist. Indeed, I would go so far as to say that they will, and that in doing so there will be some reclarification of the meaning of active investment.”

More notably, intermediaries who have a greater focus on ESG, or clients with an interest in this area, should pay attention to the fact that passive providers are increasingly entering the ESG space.

Morningstar recently noted that across Europe, active providers have been prolific in launching sustainable funds. Some 207 sustainable active funds launched in 2017, with 262 launches in 2018 and 142 in the first half of this year.

However, passive providers are also in on the act. Morningstar’s European Sustainable Funds Landscape note from the end of June found that 33 passive sustainable funds launched in 2017, with 43 new offerings coming to market in 2018 and 26 in the first six months of this year.

This has involved some big names, with S&P Dow Jones and MSCI each launching a range of ESG indices earlier this year. But a wider trend appears to be unfolding.

While the majority of launches may still be active names, the broad nature of passive investment means fewer trackers would be required to cover the market.

Passive sustainable funds are also attracting a “growing share” of net new money, according to Morningstar. Some 24.1 per cent of new inflows went into passives in the first half of 2019, compared with 24.3 per cent in 2018 and 20 per cent the year before.

As such, the product set available to investors is rapidly broadening out.