Asset classes go in and out of favour.

Sometimes they are loved; sometimes they are not. And UK equity funds are currently being shunned, according to Investment Association (IA) statistics.

The IA’s recently published figures on how savers invested in August show that UK equity funds waved goodbye to nearly £700m in net retail outflows.

They were not alone, as all regions experienced significant outflows that month, apart from the US, which enjoyed net retail sales of £70m.

But even with Europe close on its heels at £536m, the UK equity-fund outflows were considerably bigger than the others.

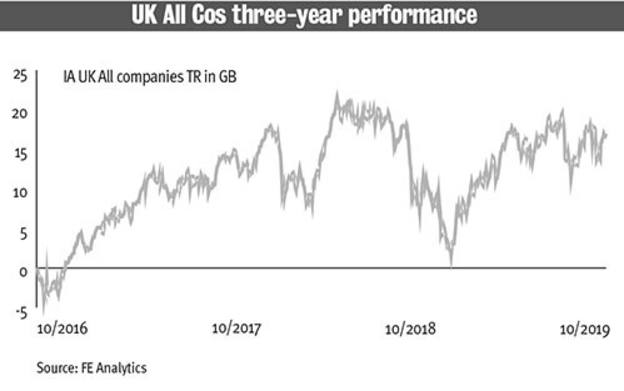

And UK equity funds’ unloved status is not a blip. So, just why are investors deserting UK equities in droves?

In the IA’s previous month’s report, Mr. Cummings alluded to the spectre of political turbulence, as he commented: “Appetite for stocks and bonds was poles apart in July 2019, as savers looked to weather the ongoing political and economic uncertainty by diversifying their investments and seeking out safe haven assets.”

Looking at the UK in particular, Mr. Cummings added: “Investors reacted to the ratcheting up of uncertainty in the UK, triggered by the change in political leadership, by taking £1.2 bn from UK equity funds”

So, are there reasonable grounds for this UK-equity exodus, or are investors perhaps being over-fearful, in the face of the UK’s forthcoming break away from the EU?

Fear and anxiety

“It makes sense for people to be fearful,” says Edward Park, deputy chief investment officer at Brooks Macdonald Asset Management:

“And the political turmoil makes it easier for asset allocators to shun the UK. They are not being foolish; there are cheap valuations elsewhere.”

Chartered financial planner, Keith Churchouse, of Chapters Financial also believes that anxiety is a contributing factor, as he comments: “The key word is ‘fear’.

“The majority of the UK are concerned or fearful for the future because of Brexit.”

He adds: “We believe the markets have largely factored in the Brexit position. But for the ‘man on the street’, equities have had a good run and there are profits to take, so they are taking them while they can, because the UK is going to have a tough time.

“I would also query whether there has been a ‘Woodford effect’ on UK equities and UK equity funds,” says Mr. Churchouse, reflecting on the demise of Woodford Investment Management and the impact on investors.

Summing up, he concludes: “This move away from UK equities is sentiment driven by fear.”

However, it is possible that the focus on the UK’s woes may be considered overdone.

Iain Wells, co-manager of the Kames UK Equity Income Fund points out that there is also plenty of geopolitical and economic pain in other parts of the world.