It is no wonder 2018 has been a poor year for UK equities, with the ongoing shambles of the Brexit negotiations and the internecine warfare in the Conservative Party about the UK’s departure from the EU. Debate still rages in Westminster over Brexit.

Meanwhile, in the markets, after a great 2017 with global synchronised growth, 2018 was expected to produce more of the same and there was another leg of the bull market.

In the US, President Donald Trump’s tax cuts propelled the US economy into the stratosphere and the S&P to record highs, driven in part by insatiable demand for technology and the so-called Faangs – Facebook, Apple, Amazon, Netflix and Google.

However, the strength of the US economy in the second half of 2018 caused all manner of problems, especially for emerging markets as rates and the dollar rose.

The Federal Reserve seems to be getting much of the blame for the woes of the past quarter. But in its defence, the central bank said all along it would raise interest rates four times in 2018, which indeed it has done. So why did the market wake up in October and panic?

As I write (December 13 2018), most major markets are down in 2018: with the S&P 500 dipping 0.09 per cent, the Dax 30 falling 16.54 per cent and the FTSE dropping 7.77 per cent.

You will hear this from most people in the next few weeks, but 2019 will be determined by three key things: Brexit, US interest rates, and US/China relations.

Of most importance to global markets will be the actions of the Fed. Two rate rises seem likely in 2019, though there may be more if wages rise sharply, in which case you will want to avoid emerging markets.

US/China relations have thawed slightly, with further tariff hikes postponed for three months – a good outcome to these talks could propel Asian equities this year. Indeed, any perceived positive news is enough to move markets currently.

Key points

• Most major markets were down at the end of 2018.

• UK stocks are cheap.

• A hard Brexit will lead to a sharply falling currency.

Currency is another area to watch out for in 2019, but the previous three points will influence what happens in the foreign exchange markets.

This year could see some big currency swings as markets digest ongoing news flow around Brexit, interest rates and China.

UK markets

One of the most fascinating facts of 2018 is that overseas companies were happy to buy out British businesses – Sky and Shire are two recent examples, but global fund managers will not invest here. This leads me to believe there is good long-term value to be found in the UK as otherwise business would not invest.

The UK on many measures looks cheap. The market sits around its 40-year price/earnings ratio average of about 14 times earnings, but that masks companies with dollar earnings on much higher ratings and domestically focused companies on single-figure P/E ratios.

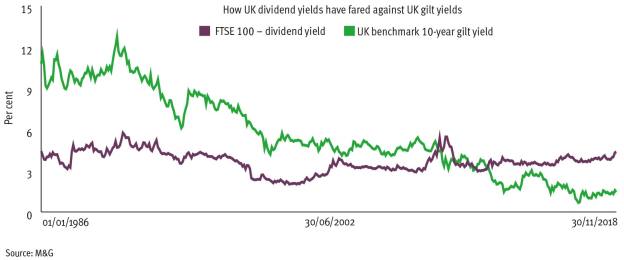

The graph shows the 10-year gilt yield against the UK dividend yield.