According to Schroders' Mr Gibbs: "The current target of Y6trn in ETF purchases a year should provide significant support for the equity market.

"The main issue is whether this can be accomplished without creating significant distortions in the market as the ultimate outcome of this policy will be to leave the central bank as one of the largest holders of Japanese equities among all investor classes."

Aberdeen Asset Management's Mr Kwok says this ETF purchasing has resulted in "gaming of certain parts of the market", although this seems to be reversing slightly with the Bank of Japan starting to favour the Topix, which is a market-cap weighted index, unlike the Nikkei.

He adds: "Whether this action stabilises equities remains to be seen."

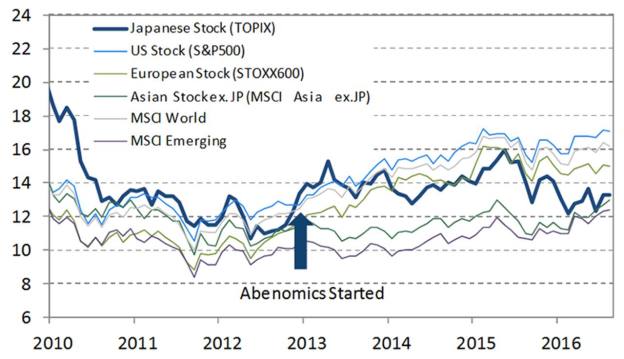

Data from Nikko Asset Management in October showed the Japanese market’s price-to-earnings (P/E) multiple is now close to its post-Abenomics low and is lagging that of other developed markets.

Abenomics refers to the economic policies advocated by Shinzo Abe since the December 2012 general election, which saw him elected for a second term as prime minister of Japan.

Abenomics is based upon "three arrows" of fiscal stimulus, monetary easing and structural reforms.

Current P/E multiples remain at approximately 13.5 times on a 12-month forward basis, compared to post-Abenomics highs of around 16 times in 2015.

Furthermore, the Bank of Japan's doubling of its annual ETF purchases to Y6trn, combined with an estimated Y6trn of share buybacks by firms will limit downside risk and set the stage for further expansion of P/E multiples, Nikko data has claimed.

But according to Katsunori Kitakura, strategist at SuMi Trust, although the Bank of Japan is attempting to "build momentum in the equity market" through the ETF purchases, this has "led to speculative trading and increased levels of rotation and volatility in the market".

He says this was most notable in the severe style shifts seen in August, when there was a shift from small to large cap, and growth to value outperformed.

"The Japanese market has experienced the effect 'wall of money' investing and this can move markets. However, this can regularly lead to mispricing of stocks, as fundamentals are ignored in purchases or sales of the broader market."

Uncertainty

Cyrique Bourbon, portfolio manager at Morningstar's Investment Management group, is not as impressed by 2016's fiscal policy.

He comments: "In light of the year-to-date underperformance, the Bank of Japan's efforts have accounted for little to nothing.