Trumpeted as a one-stop solution for those who lack the knowledge or confidence to structure their own diversified portfolio of investments, multi-asset funds have enjoyed record-level inflows in recent years, with many asset managers clambering on the bandwagon and offering ‘me-too’ products.

But the tide may be turning as investors and advisers alike question the performance of the asset class, the charges that are being levied and the skills of the fund managers.

Ultra-low interest rates among other factors catapulted multi-asset funds – at €198bn (£170bn) – to the number one spot in terms of sales in 2015.

Assets under management ballooned on the back of claims of being able to perform against poor market conditions.

With volatility likely to continue into 2017 this is an opportune time for investors to take a step back and evaluate the merits of the asset class.

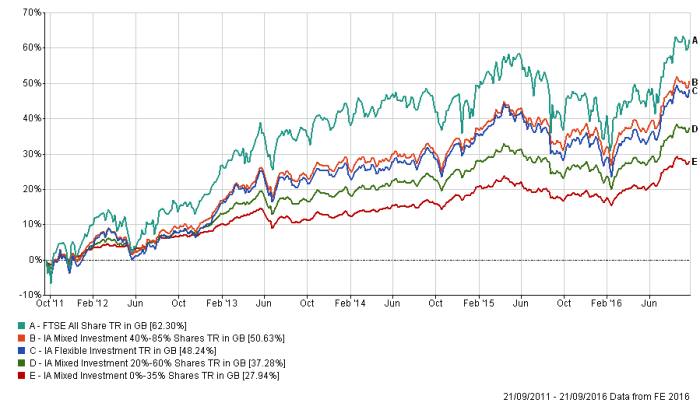

Multi-asset fund returns in the past 12 months to July 2016 have been largely negative, according to Morningstar data. Looking at asset-weighted average returns over this period, some of the more flexible sectors underperformed more conservative sectors. On average Flexible Allocation funds returned minus 2 per cent while Cautious Allocation dropped just 1 per cent. It is interesting to note that the two liquid alternative categories occupied opposite ends of the spectrum: alternative macro being the worst performer, dropping 6.41 per cent, and alternative multi-strategy inching ahead of the pack at -0.4 per cent.

Macro-alternative funds are largely failing on their promise to stay ahead of macro-economic developments. These strategies are hard to implement and difficult to explain to investors, yet the launches keep coming. It is safe to assume that many firms have added a macro-alternative fund to complete their suite of multi-asset offerings without having the requisite skill set – funds should not be launched unless managers are confident of being able to execute them well.

The alternative multi-strategy segment hosts a number of the absolute return blockbuster funds that have failed to live up to expectations, despite the sub-sector being one of the best performers. Standard life’s Gars fund continues to dominate the league table by assets under management (€45bn) but it returned a poor -7.25 per cent (by oldest cross-border share class) over the 12 months to July 2016.

Some commentators have argued that underperformance was the result of ‘wrong calls’ on the US market rather than fundamental issues with risk controls and process. However, size was likely a contributing factor to the underperformance of Gars. While global multi-asset funds have more room to manoeuvre than single-country offerings when the fund is attracting tens of billions of assets it will invariably become less nimble and performance could suffer if there are insufficient checks and balances in place. Size management is critical in order to meet investors’ expectations and avoid reputational damage.

A number of multi-strategy funds attracted new money. Aviva Investor’s Multi-Strategy Target Return fund returned a more creditable -2.0 per cent over the same period and attracted flows of over €2.5bn during the first half of 2016. In other sectors there are funds that stand out from the crowd, in terms of both performance and flows.