Lacklustre long-term performance

However, performance figures painted a bleaker picture for investors.

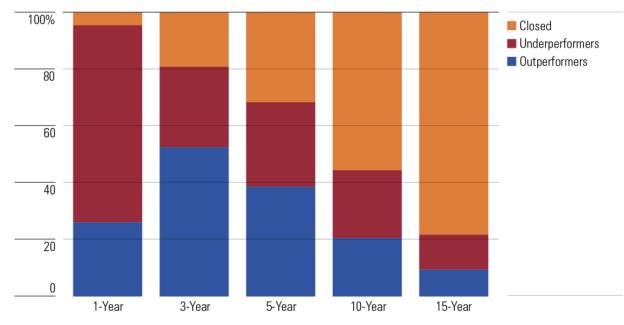

Although more than a half of the thematic funds in Morningstar's global universe survived and outperformed the Morningstar Global Markets Index over three years to the end of 2021, their success rate dropped to just one in 10 over a 15-year period.

What's more, more than three-fourths of the thematic funds that were available to investors 15 years ago have since closed, Morningstar stated.

It said: "Since the beginning of the global pandemic, many thematic funds have chalked up impressive returns.

"But thematic funds' long-term track record isn't nearly as compelling. When we stretch our observation window out to include the trailing five years, the success rate drops to 39 per cent. Over the past 15 years, more than three-fourths of thematic funds globally have shuttered and just one in 10 survived and outperformed."

It concluded: "Thematic funds' lacklustre long-term performance can be partly explained by the fact that their fees tend to be higher than those of their non-thematic counterparts."

In the US both active and passive thematic funds levied higher average management fees on average than their non-thematic counterparts.

And in 2021, more than two thirds of thematic funds underperformed the Morningstar Global Markets Index. Though they did show "stellar performance" in the year prior.

In Europe too both active and passive thematic equity funds charge higher management fees than their non-thematic counterparts, on average.

Morningstar said: "Over short periods – for example, 2020 – many of these funds survived and outperformed global equities, but over longer periods the number that survive and outperform tumbles.

"Over the trailing five-year period, less than half of these funds survived and outperformed the index. That figure plunges to just 9 per cent over the trailing 15 years."

But Steve Freedman, sustainability and research manager of thematic equities at Pictet Asset Management, said Morningstar's observations has not been reflected within the PAM thematic equities range.

Freedman said: "Taking Pictet Global Megatrend Selection (GMS) as a broad representation of Thematic equities at Pictet, since it invests equally in all of our available single-themed strategies, performance after fees has been competitive with broader global equity markets since inception in 2009, even after the recent style rotation that has negatively affected most thematic strategies.

"In addition, for a number of strategies, eg, Water, GEO, Robotics, Security or Premium Brands we’ve seen outperformed since inception on a net basis."

carmen.reichman@ft.com