Advisers have faced the same situation over and over again with newly divorced clients: one spouse took the pension, the other took the property.

On the face of it, this often seems most practical. People generally want the divorce to be as amicable as it can be, and often want it to go through as quickly as possible.

By agreeing for one person to take the house and the other to take the pension, they can avoid a court order that comes with pension splitting, and the divorce can proceed much more quickly.

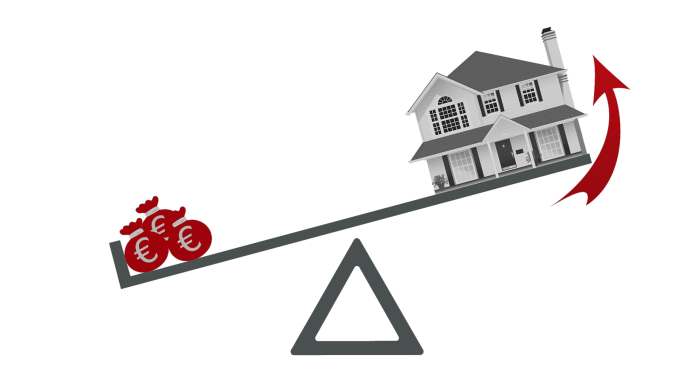

Moreover, rising house prices over the past decade have seen property wealth rise. In January this year, another 40,000 homes fell into the 'property millionaire' category, meaning more than 560,000 UK properties are now worth more than £1m.

According to Santander's underlying forecasts, property prices will have risen another 97 per cent by 2030. This means that an averagely priced home costing £280,000 today would cost over half a million in 15 years' time.

But while it might seem practical and initially lucrative for one person to take the property and the other to retain the pension in full, this often ends up with one former spouse facing pension poverty - often the woman.

A combination of a woman having taken time out of paid employment to care for children, combined with the likelihood of a return to work that means fewer hours and less pay, can wreak havoc on pension savings.

Without splitting the pension fairly, women can end up in a financially precarious position further down the line. House prices can go down as well as up. Properties are hard and costly to maintain. And what happens in retirement when the income runs out?

All too often, pension poverty among divorcees happens because the couple has failed to spend money on professional financial advice.

Emma Ann Hughes, communications director of the Personal Finance Society, says: “All too often, legal advice on divorce focusses on carving up the former marital home, yet how the pair’s pensions are divided can be even more important."

Neil MacGillivray, head of technical support at James Hay, comments: "It’s all too common in a divorce that pensions are not considered as an asset to be split between the parties. Indeed, Family Law Court data suggests only around 15 per cent of divorces result in the splitting of pension rights.

"The major disadvantage for women, who’ve perhaps reined in their own careers to look after a family, is that if no pension sharing is agreed, they may lack the time to build up a sufficient pension themselves."

Assessing the scale of the problem

How big a problem is this?

"Enormous", says Debora Price, professor of gerontology at the University of Manchester, who has studied the problems facing women's pensions for 40 years. She believes it is a major contributor to pension poverty among thousands of divorced female pensioners.